Overview

It is nearly a year since the terrible 7.8 magnitude earthquake struck Barpak, Gorkha. The massive earthquake on 25 April 2015 at 11:56 AM and subsequent aftershocks (two powerful 6.7 of magnitude on 26 April and 7.3 of magnitude on 12 May) caused widespread damage to lives and properties. About 9,000 were dead and 22,000 injured. Around 602,257 and 285,099 private houses were fully and partially damaged, respectively, forcing thousands of people to seek temporary shelter under tents and tarpaulin sheets, factories, cultural heritage sites are also damaged and slowed economic growth. In addition, revenues underperformed leading to a deficit. A rise in remittances after the earthquake to help affected households cope with the tragedy and smooth their consumption provided the requisite stability to the economy resulting in a strong current account surplus and growing reserves.

After the devastating the earthquake, Nepalese economy was struggling to regain the position and heal the disasters. With inflation at a seven-year high, sharp decline in trade during the months when border points remained obstructed and decline in both revenue and expenditure of the government, macroeconomic indicators point towards an unsatisfactory position for the country this fiscal year.

However, the country is hopeful of covering some lost ground in terms of lost revenues and contracted trade volumes in the final few months of the fiscal year given that the border disruptions lifted and supplies gradually normalized. A lot of this hope, however, remains stuck upon how well different sectors of the economy recover from the crisis though growth will continue to be affected in FY2016 due to delays in set-up of the reconstruction authority and increased political instability. As the political process stabilizes, and recovery starts in full, growth is expected to rebound.

Economic growth

Due to the economic slowdown after devastating earthquake and obstruction in boarder and political instability, Nepal’s economic growth and overall macroeconomic situation couldn’t be stable therefore real GDP is projected to down up to 1.5% in FY 2016. Because of the disruption in trade across the border have encouraged the economic activities to underground which cannot be traced in the real GDP and revenue collection and exports were depressed, supply for raw material obstructed which narrowed the production leading inflation with higher base, Weak monsoon with a slightly delayed onset, coupled with the lack of adequate chemical fertilizers due to the trade disruption, have diminished agriculture production.

Fiscal performance

Fiscal performance has been sound and the budget deficit low and stable. Some challenges persist however these are related in particular recurrent expenditures which increased 7.4 percent this year corresponding to previous year, capital expenditures increased only 1.1 percent, the post-earthquake reconstruction works remained affected on account of the shortage of fuel and construction materials. In comparison to the previous year, it is highly lower increment in capital expenditure.

The tax collection was significantly affected as a result of the blockade where customs and excise taxes, which combined made up 31% of the revenue in the previous year, directly dropped while Value Added Tax (VAT) and income tax also declined. Customs and value-added tax on imported items the largest portion of the overall revenue mobilization. The projected total revenue collection will be NRs354.4 billion, which is 25.4% less than the budget projection of NRs475 billion.

On the other hand, total expenditure is estimated to be NRs544.4 billion, or 33.6% less than the budget allocation of NRs 819.5 billion. In FY 2016 Both the revenue and expenditure projections may be higher as the Nepal Reconstruction Authority is expected to ramp up its expenditure in the next six months, while revenue generation is also expected to be higher. Overall, the estimates indicate that the economy will have a larger fiscal deficit than the previous year in FY2016.

Inflation

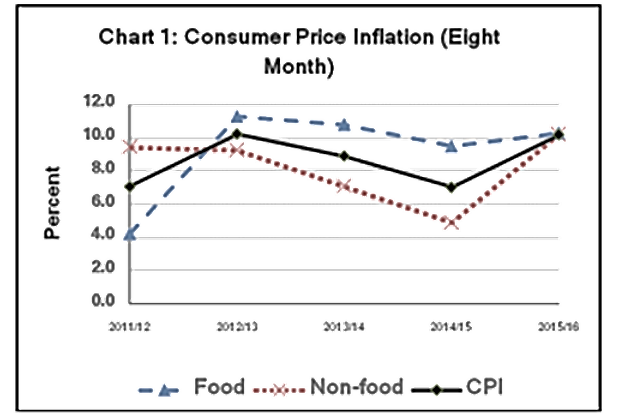

For the first two months of FY 2015-16, the Consumer Price Index (CPI) hovered fairly around 7%. However, post mid-September 2015 i.e. the advent of the blockade, the continuous steep rise in inflation could be noted as shown in the figure with CPI levels reaching the double digit figures, at 10.4% in mid-November 2015 rising up to 12.1% in mid-January 2016.

| Source: Current Macroeconomic and Financial Situation of Nepal, NRB |

This increase, for the most part, is accounted by the supply crunch resulting from border disruptions in the Terai-Madhes region, which put an upward pressure on prices especially on food and beverage commodity groups. With the blockade easing out, inflationary pressure on prices is expected to ease.

External Sector

Remittances of citizens working or living abroad have been crucial in maintaining overall external sector stability. Given Nepal’s international trade occurs almost exclusively through India and that Nepal-India border points remained disturbed owing to the Madhes protests, movement of goods to and from India was severely curtailed; as a result imports and exports of merchandise marked stark falls in the review period. Compared year on year to the previous year, the imports fell by as much as 36.8% in mid-November 2015; while, exports fell by 29.1% in the same timeframe. Nonetheless, with Nepal’s import bill far exceeding the exports, the drop in imports helped in improving the trade balance, reducing the deficit by 37.8% in mid-November 2015. The remittances have also been a key to maintaining a current account and balance of payments surplus despite the wide trade deficit. The stability of the external sector remains vulnerable to fluctuations in these inflows. Foreign exchange reserves were sufficient to cover 15.8 months of imports of goods and non-factor services.

Exchange rate volatility

As a result of the peg with the Indian rupee, exchange rate of Nepalese rupee is determined by the movement of the Indian rupee. The Nepalese rupee has also depreciated rapidly against the US dollar in recent times, previously remain fairly stable. The decline was complicated by India’s slow economic growth and a widening current account deficit and due to the inflation differential between Nepal and India, the currency $1 was equivalent to NRs108.2 as of February 2016. While the nominal exchange rate of the Nepalese rupee is fixed with respect to the Indian rupee, the bilateral Real Exchange Rate (RER) – which captures the relative price of goods across the two countries – has appreciated considerably in the last year, the bilateral RER regarding India had increased by 45.8%

Migration and remittances

In the previous year, more than 1,200 Nepalese leave the country every day due to the lack of job opportunities at home and the lure of high wages abroad. This outmigration to find work in destinations such as Malaysia and the Gulf States has resulted in a shortage of workers in the agriculture and industrial sectors.

The number of workers going abroad for foreign employment directly affect the remittance. Due the decrease in the number of the worker going abroad, the subsequent earnings from remittances is expected to decrease in the coming years. As a result of declining the global oil prices which affect the aggregate demand of worker in the Gulf country. Therefore out-migration rates are not expected to rise in the following year.

REFERENCES

Asian Development Bank. (2016). Asian Development Outloook 2016 Asia’s Potential Growth. Asian Development Bank.

Asian Development Bank. (2016). Macroeconomic Update Nepal. Asian Development Bank, Nepal Resident Mission.

Nepal Economic Forum. (2016). Docking Nepal’s Economic Analysis. Lalitpur: Nepal Economic Forum.

Nepal Rastra Bank. (2016). Current Macroeconomic and Financial. Kathmandu: Nepal Rastra Bank.

No comments:

Post a Comment